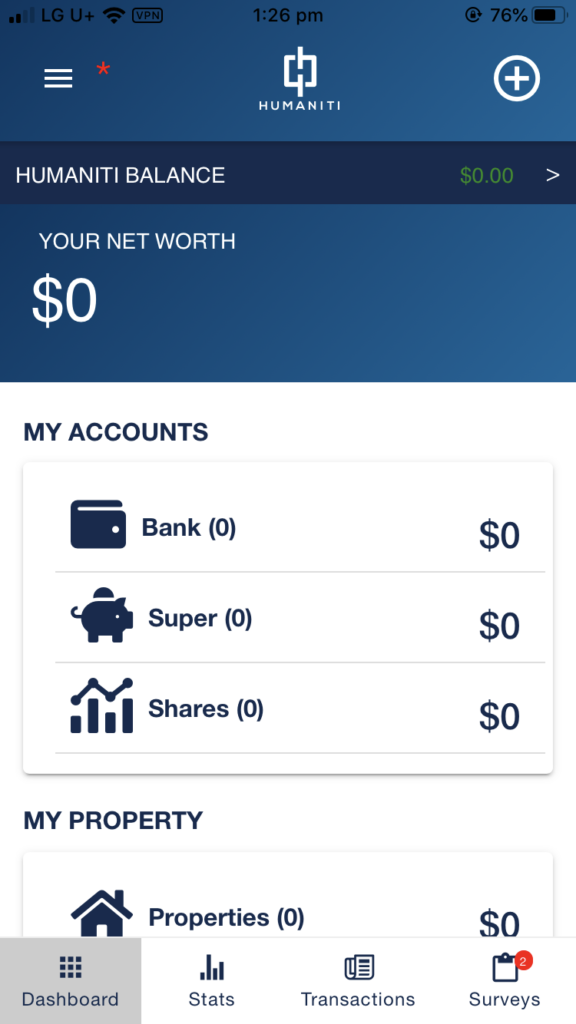

Humaniti is a new personal finance tracking app in the same vein as the popular mint.com in America. It allows you to collate all your bank, super and investment accounts into one combined view. While there are some similar apps like Pocketbook, none have exploded in popularity. Will Humaniti replace your spreadsheets and become the go to app for personal finance tracking in Australia?

Is Humaniti safe?

My and probably many others main concern with Humaniti is the safety and security of the app. Personal and financial data is extremely important to keep secure due the amount of damage that could be caused if it falls into the wrong hands. Since Humaniti is dealing with this information, we need to be sure our data will be safe and secure. They claim to be using banking level security and encryption for all your information and details in the app. However, my main concerns lie with how Humaniti gets the data from your various accounts.

Enter Yodlee

Humaniti uses a third party company called Yodlee to access your various accounts and extract transaction and other financial details into Humaniti. Yodlee is a large company that has been doing this for years and is the biggest player in this space in the US. However for all this to occur automatically you need to give up your username and password for each account.

Even with the banking level security claims this is a huge red flag. With this information Yodlee/Humaniti has full access too your account and could potentially drain the funds. Of course you should be protected by the law in such a situation, but resolving it could take time while you are stuck out of pocket. This is major concern and there are many disputes going currently as to how it should be regulated and who is liable for any issues that arise.

What do the bank’s think of Humaniti?

I contacted one of my banks, ING, as too their stance on Humaniti and whether I should give up access:

Hi,

I have just found out about this new app/website called Humaniti (https://www.humaniti.com/) that allows you to consolidate all your bank, super and share accounts for a holistic view. However I am a bit concerned about the security of their operation as they require my access code and password to get data from my ING direct account. I don’t understand how this can be safe as they could just be recording this sensitive information. Is ING aware of Humaniti and how they are accessing account information? They say they only have read-only access but with an access code and password they would have full access to my account correct?

Thanks.

And their response:

Hi,

Thank you for your message. We don’t suggest using any service that we requires you to provide your client number and access code. This is because these details allow access to your funds and personal details and is a direct breach of our security terms and conditions. In most cases it’s a person logging into your details, not software, too.I hope you have a nice afternoon and weekend ahead.

Regards,

Erin

So ING aren’t a fan of giving up access to bank accounts. So to give Humaniti a real run I decided to use an old CBA account that I don’t put money through to test out the app. Even They sent me an nice email asking if I had recently giving out my login information to a third party with this link. So it seems banks aren’t a fan of this service at the moment.

A possible solution?

One solution is to offer read only access to third parties to allow for this type of financial analysis. However this is still concerning with the data mining and marketing potential of all your transaction and financial information.

The Humaniti app

So using my old CBA account I signed up and linked the account so I could try out the app. Frankly, the app is clunky and buggy. Especially compared to other personal finance apps in the market like Spaceship Voyager. It doesn’t seem to be a native app developed for phones, rather a web app in a app wrapper. It even stops music playing whenever its open. The app needs major work in my opinion, its slow, buggy and the UI/UX design is old and not flattering.

Transactions and Stats

The app pulled all my old transactions quickly and seamlessly. But the analysis is limited and the graphs/displays look clunky.

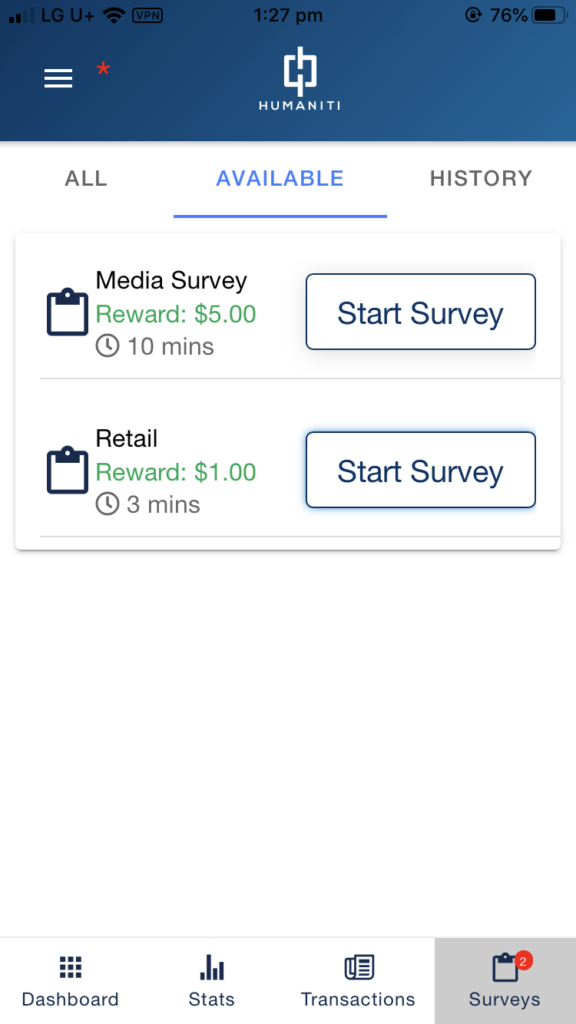

Surveys

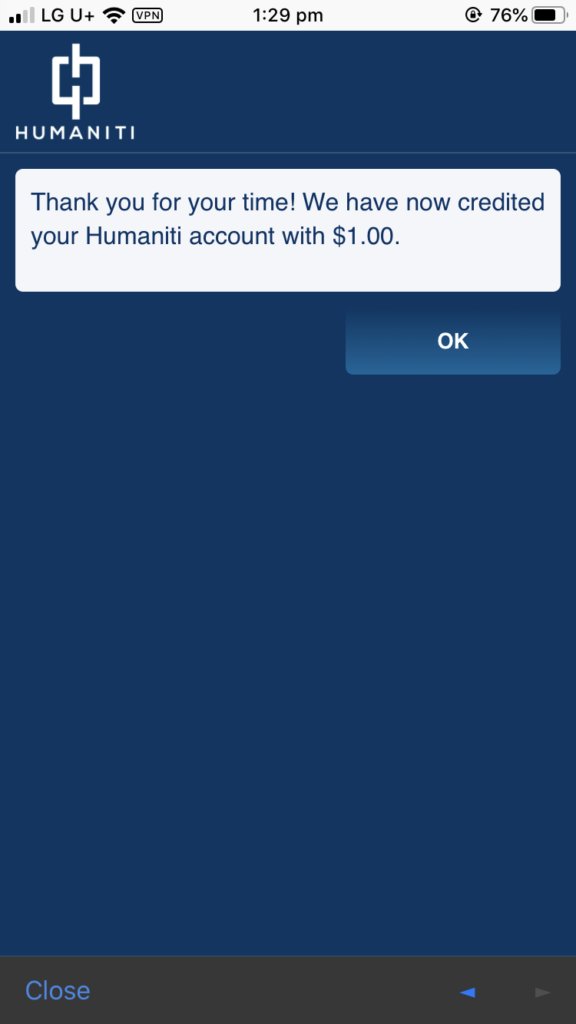

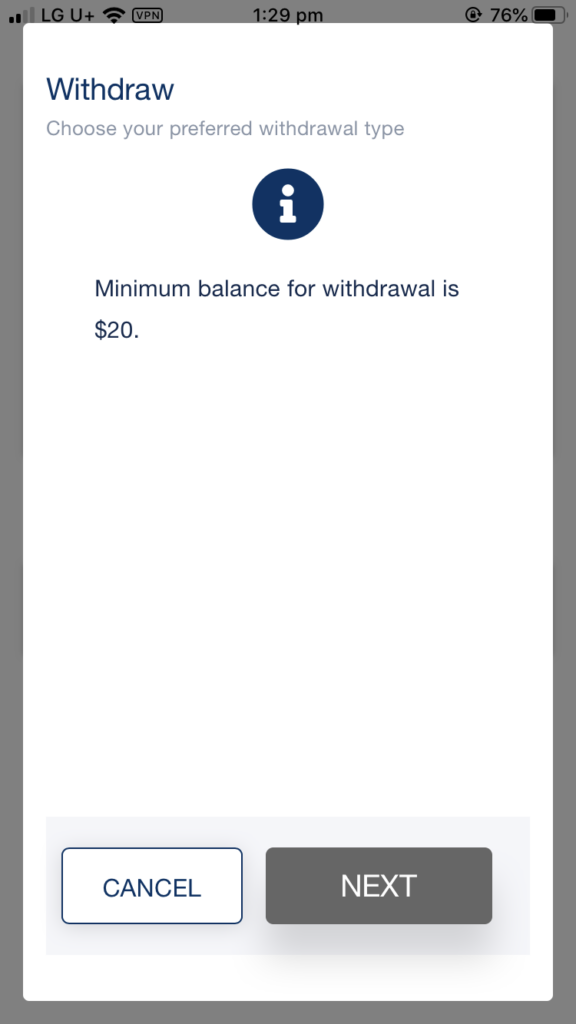

Surveys are similar to what you might see on a site like SwagBucks. They range from topics like telecommunications preferences to surveys about the Humaniti app. You aren’t going to make a lot of money but you may make a couple of dollars a week. Not really worth the time investment especially considering you need to earn over $20 to be able to withdraw. Maybe my earnings will show up in a future income report.

Humaniti app survey listing.

Survey completion – Humaniti app.

Humaniti app withdrawal limit.

Summary

Overall, a good idea for some people who want to track visualise their income and assets. However, it is riddled with problems ranging from security and privacy to the clunkiness of the app. The app really needs an overhaul and regulations need to be placed around how these companies handle accessing your financial data. The surveys function goes no where towards redeeming any of these features.

I can’t strongly recommend anyone really use this application due the above mentioned issues but if someone wants to try it out you can get a $5 bonus to your Humaniti balance by using the code, W4QG3R, when signing up.

Has anyone else try out Humaniti? What did you think? Or are you willing to try it out? Let me know below, I would love to hear your opinion.

1 thought on “Humaniti App – Australia’s new Mint.com?”