Update(06/11/2019): RateSetter is now offering a $50 bonus to people who make a minimum deposit of $1,000 into the 1 month rolling or 5 year income markets before 31st December 2019. Sign up for an account here to get the $50 bonus added to your account. Also I have just posted a final recap and goodbye to RateSetter now that my divestment is completed.

Update (09/07/2019): RateSetter is now offering a $75 bonus to the first 2,000 people who are referred and make a minimum deposit of $2,000 into the 3 or 5 year markets. Sign up for an account here to get the $75 bonus added to your account.

RateSetter, a peer to peer lending platform, the first of its kind for retail investors in Australia. It has come to Australia after finding success in the UK. Additionally they differ from their American counterparts, Lending Club and Prosper, by introducing a provision fund.

This provision fund is there to protect the investors (or possibly RateSetter itself) in the case of loan defaults. Ideally whenever the a loan goes into default on the provision fund can pay back the investor while RateSetter pursues recourse options. Each borrower pays an extra fee to go to the fund when they take out a loan. As far as I know RateSetter have never had to access the provision fund to repay investors. The fund currently has a value of just over $11.1 million, and RateSetter estimate there is around $7.7 million in bad debt.

I started using RateSetter in August 2016 (21/07/2016), although I had an account earlier while investigating the platform. Eventually, I decided to invest in the platform and put $1,000 into a 5 year loan at 9.9% (currently returning a rate of 8.4%). I also set the interest payments to be reinvested in the 1 month loan market. These rates have trending down from ~3.6% to close to 2.4% these days. All the rates have trended down over time, there could be many reasons for this. Nevertheless it makes the investment proposition much weaker than when they first released.

Additionally there is a major caveat to the advertised rate. The rates show on the home page and loan investment screens are dependent on the interest payments being invested into the same market.

My RateSetter Lending Returns

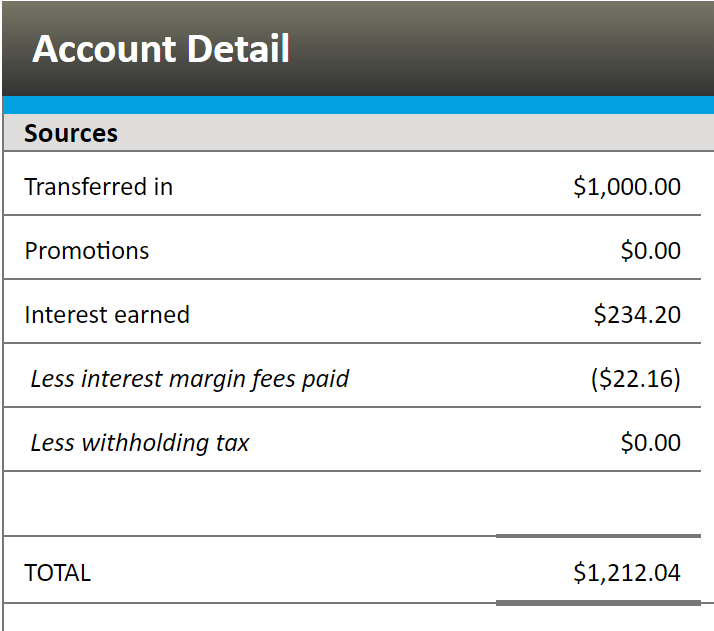

In the image above you can see the lending details from my account. So, I have invested $1,000 and received $234.20 in interest; reduced $22.16 by fees paid to RateSetter. Over 905 days (to 12/02/2019), I have received interest of $212.04 which works out to be a whopping 23 cents per day! Annualising the return over the life of the loan I get a overall return of 8.5%, not bad. However, I believe this would go down over time due to the lower and lower rates for each of the markets as I reinvest.

This is actually one of the reasons I stopped my reinvestment plan and am starting to withdraw funds. I will let my 5 year loan finish paying off but I will not invest anymore more money. I am put off by the reduced interest rates over time as well as RateSetter changing the PDS to improve their fee structure. Additionally I am dubious of this platforms ability to be stable during a recession, which I think is possible for Australia to enter soon. For all these reasons I will wind back my invests and look to put them elsewhere.

Potentially redeeming offer below

Currently, RateSetter are offering a $150 bonus when you sign up and invest $2,000 or more into the 3 or 5 year loan markets. This is definitely a good boost when starting your account. It should also offset the reduced rates a bit, but they could drop further. Also defaults are likely to go up in the event of a recession, which Australia could be headed towards.

What are your thoughts on RateSetter? Have you invested? Thinking of winding back RateSetter investments? Thinking of investing and got questions? Leave a comment below and let’s discuss!

Thanks for sharing this. I have used Ratesetter over the last two years and have noticed their one-year rates go down significantly over that time; I suspect due to increased supply of funds from lenders. I concentrate my efforts now into term deposits (eg. through ING) or micro-investing through Raiz for those funds I need readily available. For larger amounts, I continue to buy ETFs on the share market of Vanguard’s VAS (Australian index fund) and VGS (international index fund).

Keep up the blogging efforts, Lachlan.

Thanks Michelle, how do you find Raiz for the micro-investing? I thought the fees were rather high. Is Spaceship possibly a better option for micro-investing, it is fee-free for under $5,000.

Also are term deposits faring well these days? I thought most of the high interest savings accounts had just as good interest rates with much more flexibility.