If you got some crypto sitting around waiting for it to moon. Or if you got in on the craze at the worst time. You could look into margin funding to make money while waiting or reduce your losses.

Margin funding is basically lending your money to someone who wants to bet on a currency/commodity/stock going up. Being on the borrowing side can be risky, with plenty of downside if things go wrong. However being the lender you are generally covered by the collateral of the borrower if things go pear shaped. The lender will also make some money on interests payments for the period of the margin loan.

Margin funding is typically perform by large investment banks and is inaccessible to the average person. However, as crypto has disrupted a lot of the finance industry; it also allows the average person access to be a margin lender.

Enter Bitfinex

Bitfinex is a cryptocurrency exchange and investment platform that allows you to get involved in margin funding. I have been using it for over 2 years to do margin funding and haven’t had any issues. But this is not an indication of future situations, so take that into account.

Bitfinex make it super easy to lend out your spare cryptocurrency to earn you some interest payments; instead of it just sitting there idle. You can choose how mich you want to lend out. The maximum period of lending. And the rate, I usually use just the current rate to ensure I get matches. They also handle the collateral component of the margin funding. Bitfinex has great support article explaining their mitigation strategy here. This technique can be quite risky due to the volatility of cryptocurrency and the potential for defaults. You need to take into account the risks and decide if this investment is for you or not.

My Results

Here is a quick look at some of the returns I’ve received.

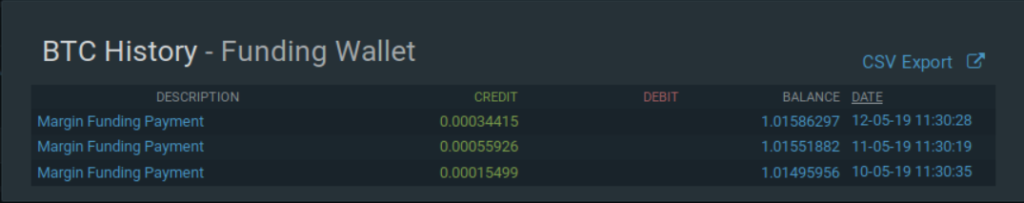

BTC Returns

In this case I have lent out 1 BTC to lenders at the current when it goes on the funding market. Due to some reporting issues I can’t get my full history of lending transactions.

Over 3 days recieved 0.00015499, 0.00055926 and 0.00034415 BTC. At current rates this converts to AUD at ~$1.81, ~$6.53 and ~$4.02. Small sample but lets average that out to $4.12 per day. If we can get that average return every day that would be $1,503.8. The initial investment is worth ~$11,700 currently. So the ROI on this investment ~12.8%. That is pretty impressive for a passive set up. Of course that is a small sample of data and there is a lot of risk. But if you are involved in crypto, you are likely comfortable with that risk already.

Returns could be even better if we used my original lower buy in price; however I am just trying to show the returns without the volatility.

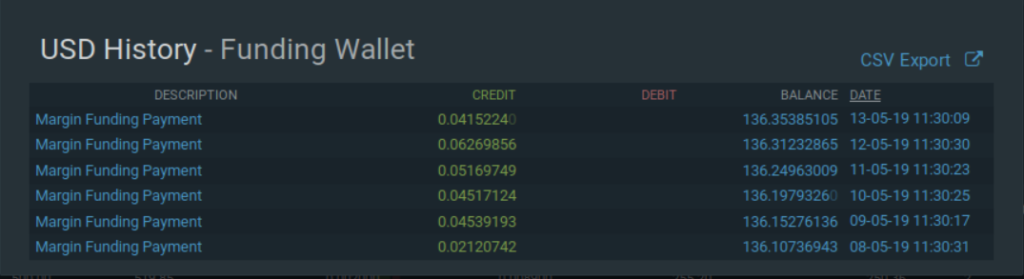

USD Returns

Another option which is arguably more accessible and safer is lending USD to crypto margin traders. Lending USD keeps the same collateral mitigation strategy but removes the potential crypto volatility. Again I don’t have a whole lot of transaction history as the reports aren’t showing it all.

Over 6 days I received USD payments of ~$0.021, ~$0.045, ~$0.045, ~$0.052, ~$0.063 and ~$0.042. This averages out to ~$0.045 a day; and over a year adds up to $16.43. From an initial investment of $135 this gives and ROI of ~12.1. This is very similar to the BTC lending returns without the potential crypto volatility.

Wrap Up

So there we go, I’ve had some success with margin lending in the crypto environment using Bitfinex. However, there are still some risks and you need to make sure you are comfortable with this investment. The returns are great so far and I’m considering putting some more money into USD lending. Much more passive than the matched betting I’ve been doing. I’ll also probably start adding this income to my income reports, although I might exclude the BTC returns due to volatility.

Thanks for reading, if you have any questions I happy to have a go answering in the comments below :).